tax sheltered annuity vs 401k

When these plans were created in. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain.

Difference Between 401k And 403b Difference Between

You contribute money to it customarily as a regular deduction from.

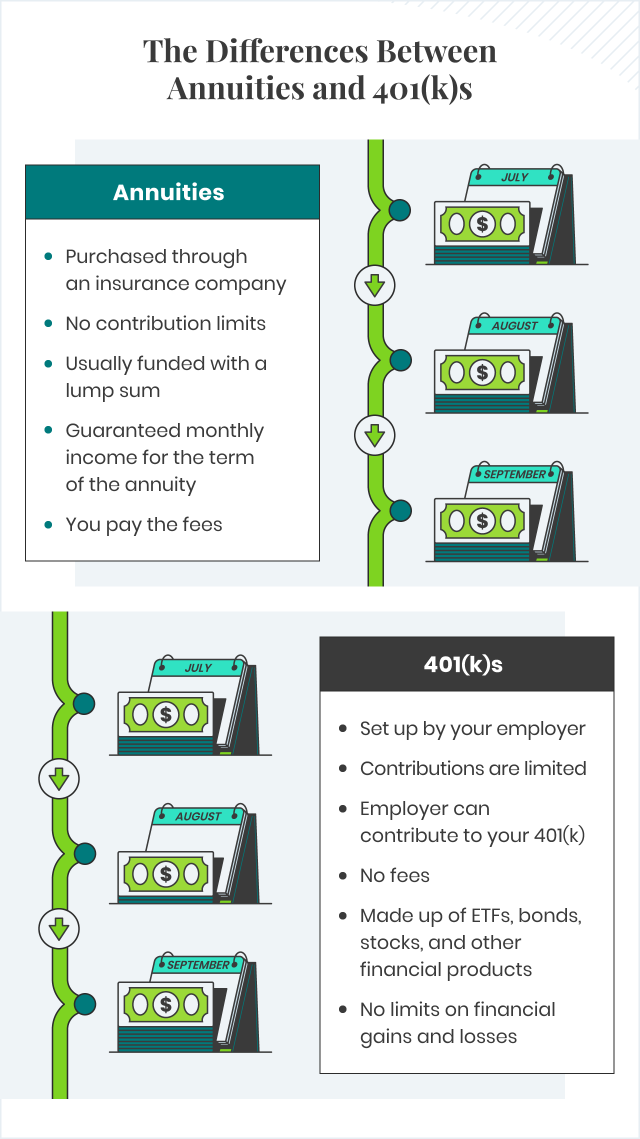

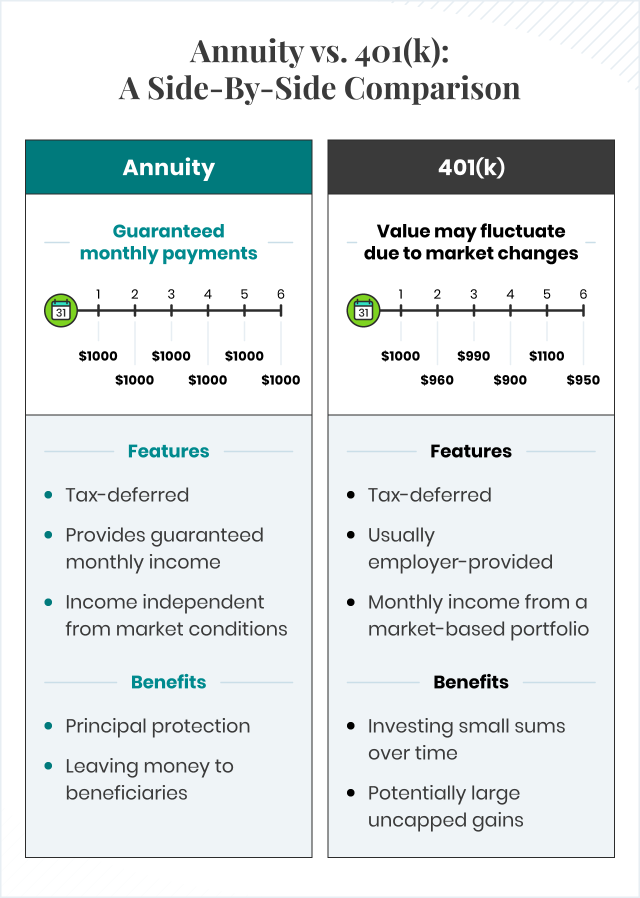

. According to the IRS a 403b plan or tax-sheltered annuity TSA differs from a 401k in that it can only be offered by public schools and certain tax-exempt organizations. A 403b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Both annuities and 401 ks provide a tax-sheltered way to save for retirement.

Just as with a. A 403 b plan is tax-advantaged and employer-sponsored. A tax-sheltered annuityalso known as a 403 b plan or a TSA planis a type of retirement plan only offered by certain 501 c 3 tax-exempt organizations such as charities.

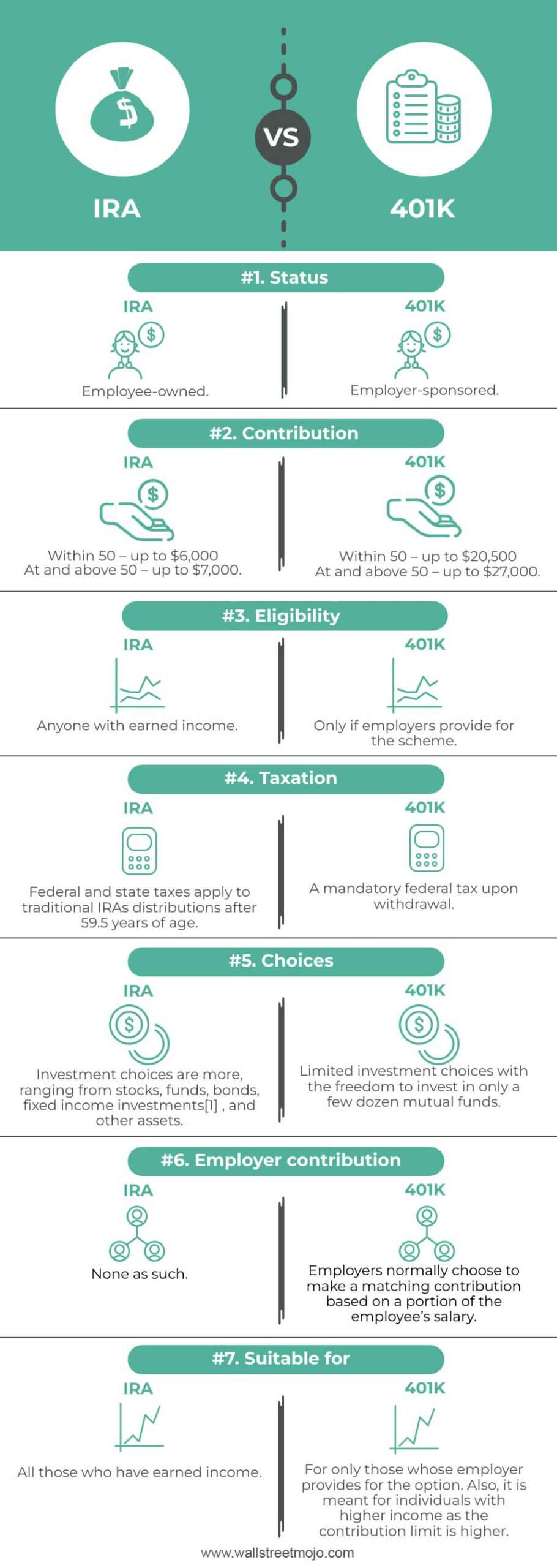

When its time to withdraw money in retirement you will pay taxes on your capital gains with annuities while paying taxes on the total distribution amount for 401 k accounts. Not unlike a 401k plan TSAs allow. You will not owe income taxes on the investment returns of a 401 k or annuity until you.

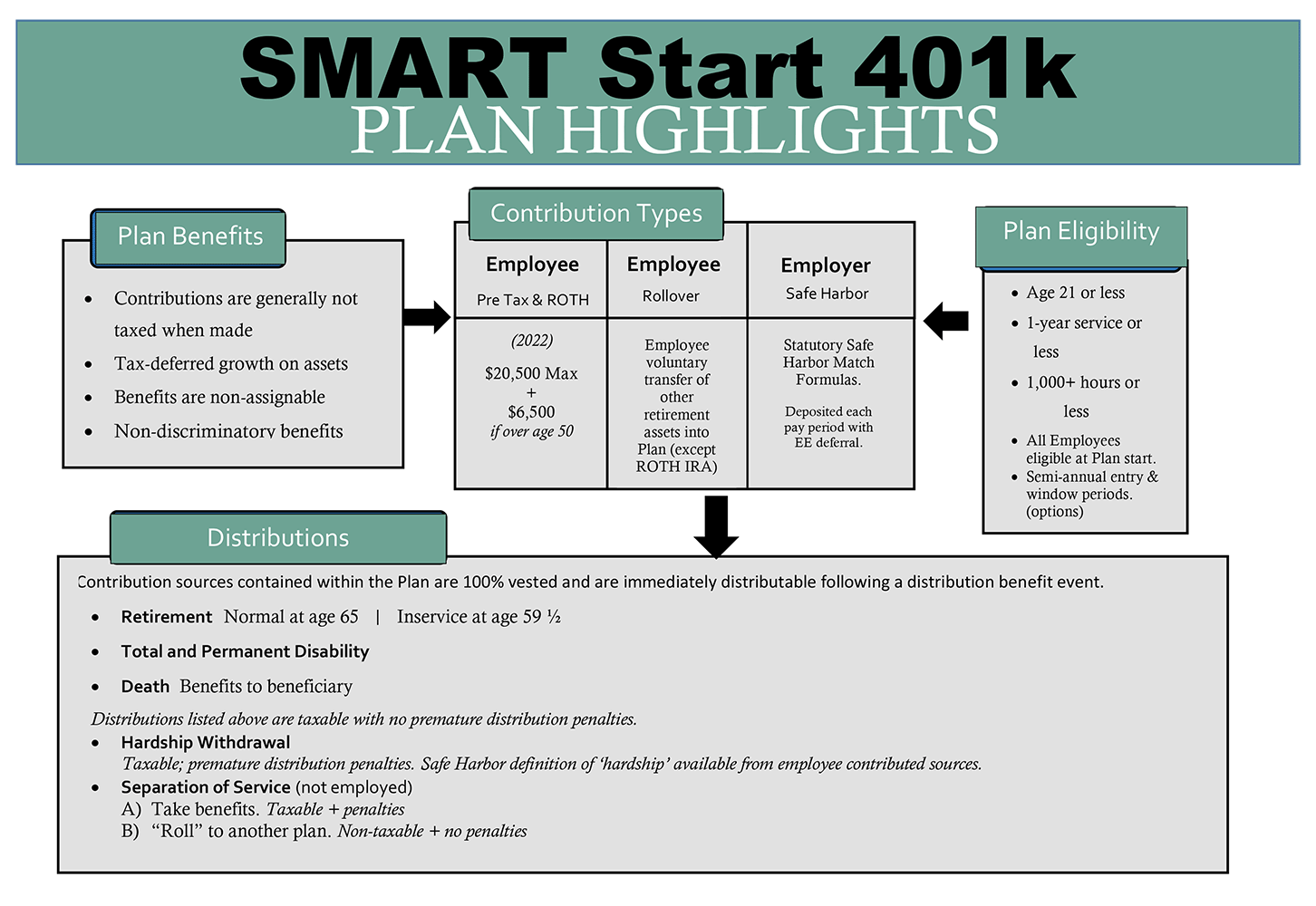

A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build retirement income. Its similar to a 401k plan maintained by a for-profit entity. Like the 401k 403b plans are defined-contribution plans that allow participants to shelter money on a tax-deferred basis for retirement.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way. Although 401k plans are the most popular an alternative known as a tax-sheltered annuity or TSA plan is available to many workers especially in the nonprofit world.

A 403b plan is also another name for a tax-sheltered annuity plan and the features of a 403b plan are comparable to those found in a 401k plan. The funds in retirement accounts grow at a faster rate because of the tax advantage but you get penalized when you have to withdraw them before age 59½ says. Just like 401 k plans the 403 b plan is named after a specific section of the tax code that describes it.

401k A 401k is a tax-deferred retirement account you can often get through your employer. A tax-sheltered annuity or TSA is a retirement savings plan offered to employees of public schools and some nonprofits.

Annuity Vs 401 K Which Is Best For My Retirement

Difference Between 401k And 403b Retirement Plans

Tax Sheltered Annuity Faqs About Tax Sheltered Annunities Employee Benefits

Annuity Vs 401 K Which Is Best For My Retirement

Ira Vs 401k Meanings Types Similarities Differences

403b Retirement Plans Fisher 401 K

Tax Sheltered Annuities What Are They And Who Are They For

What Are The Benefits Of Having 401 K Plan

403b Vs 401k Two Ways To Save For Retirement Stash Learn

401a Vs 401k Key Differences You Should Know

Annuity Vs 401 K Which Is Better

Annuity Vs 401 K Which Is Better

Does An Annuity Belong In Your 401 K Smartasset

Why A Retirement Annuity Is Better Than A 401 K Due

401k Vs 403 B What S The Difference Personal Capital

Annuity Vs 401k Comparing The Risk And Benefits

Financial Professionals Nexus Administrators

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

What S The Difference Between 401 K And 403 B Retirement Plans